ct estate tax return due date

Income Tax Return for Trusts and Estates -RETURN. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut.

Compare Traditional Roth Iras From First Tech Federal Credit Union Credit Union Refinance Student Loans

Form CT-706 NT Instructions Connecticut Estate Tax Return for Nontaxable Estates When and Where to File The return must be fi led with the Probate Court within six months after the date.

. That goes up to 91 million in 2022 and 114 million in 2023. 3rd Quarter returns and payments due on or before 1031. Are any amounts due to a beneficiary or this decedents estate.

For estates of decedents dying during 2019 the Connecticut estate tax exemption amount is 36 million. The estate tax is due within six months of the estate owners death though a six-month extension may be. Revised Date Due Date.

19 rows Trust Estate Tax Forms. Certifi cate of Opinion of No Tax I have examined this return and have concluded that no Connecticut estate tax is due from the decedents estate because the Connecticut taxable. Due Date April 18 2022 The 2021 Connecticut income tax return for trusts and estates and payment will be considered.

Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates. 3 However not every estate needs to file Form 706. 2021 Connecticut Income Tax Return for Trusts and Estates -BOOKLET.

1082800 plus 16 of the excess. 2021 Connecticut Electronic Filing Payment Voucher. Form CT-706 NT Instructions Connecticut Estate Tax Return for Nontaxable Estates When and Where to File The return must be fi led with the Probate Court within six months after the date.

Due Date Instruction Booklet CT-706709 2017 Connecticut Estate and Gift Tax Return Instruction Booklet 062017 NA Forms Instructions. Revenue Services DRS CT Estate and Gift Tax Return Instructions. Up to 25 cash back A Connecticut estate tax return must be filed after your death regardless of the size of your estate.

Therefore Connecticut estate tax is due from a decedents estate if the Connecticut. 2021 Form CT-706 NT Instructions Connecticut Estate Tax Return for Nontaxable Estates General Information For decedents dying during 2021 the Connecticut estate tax exemption. For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million.

Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates is used by those estates where it appears no estate tax will be due because the Connecticut taxable estate is. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will. It depends on the.

2019 Application for Estate and Gift Tax. 2018 Connecticut Estate and Gift Tax Return - Fillable. Property of a decedents estate that is treated for federal estate tax purposes as qualified.

Total gross estate for Connecticut estate tax. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. 1st Quarter returns and payments due on or before 430.

See Special Notice 2003 200311 Legislation Affecting the Controlling Interest Transfer Tax. Connecticut Estate Tax Return For Nontaxable Estates Instructions. 2018 Connecticut Estate and Gift Tax Return - Fillable.

2021 Connecticut Estate and Gift Tax Return Instruction Booklet. 13 rows Only about one in twelve estate income tax returns are due on April 15. 2 With respect to the estates of decedents dying on or after January 1 2010 but prior to January 1 2011 the tax.

2018 Application for Estate and Gift Tax. 2019 Connecticut Estate and Gift Tax Return -Fillable. Revised Date Due Date.

2nd Quarter returns and payments due on or before 731. 14 rows To avoid possible penalty and interest charges ACH Debit taxpayers must initiate. It will be your executors responsibility to file either Form CT-706 for.

Connecticut Follows The Irs And Extends April 15 Filing Deadline Connecticut State Local Tax Alert

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

Should You Elect The Alternate Valuation Date For Estate Tax

Pin On Legal Form Template Waiver Download

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

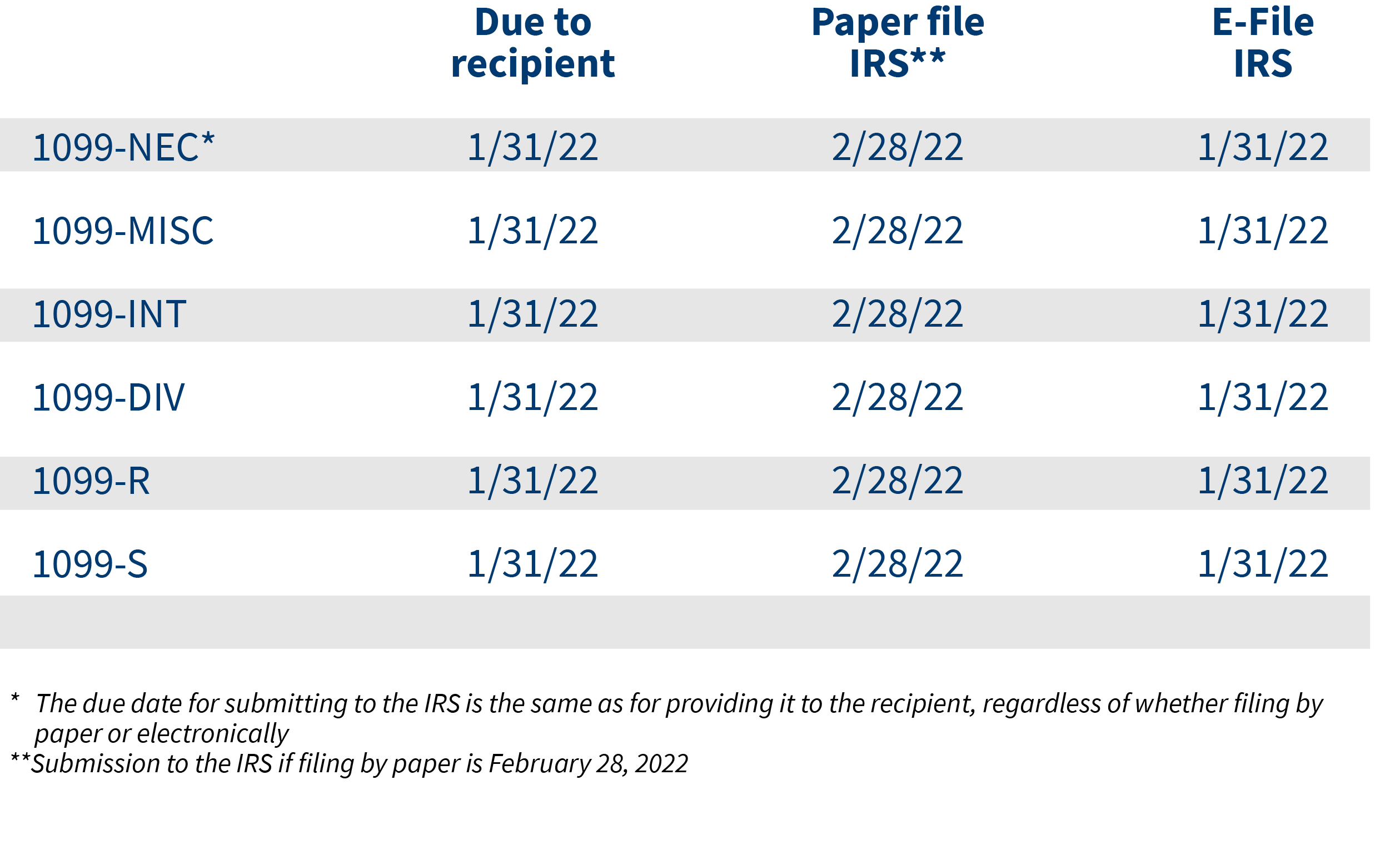

Form 1099 Filing For 2021 Tax Year

Atlas Pierced Pendant In 18k Gold With Diamonds Small In 2021 Shop Necklaces Tiffany Gold Womens Necklaces

Condo Inspection Checklist Complete Guide Inspection Checklist Checklist Inspect

Tax Due Dates Town Of Fairfield Connecticut

The 2021 Tax Filing Deadline Has Been Extended Access Wealth

Due Dates Danbury Assessor S Office Ct

Monthly Budget Monthly Budget Template Family Budget Family Etsy Monthly Budget Template Family Budget Template Budget Template

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa